BTC Price Prediction: $150K Target in Sight as Institutional Demand Offsets Whale Sales

#BTC

- Technical Breakout: BTC holds above key MA with improving MACD momentum

- Institutional Catalysts: MicroStrategy's expanded buying and corporate treasury adoption

- Macro Tailwinds: Crypto's role as a debt crisis hedge extends bull cycle potential

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Despite Short-Term Volatility

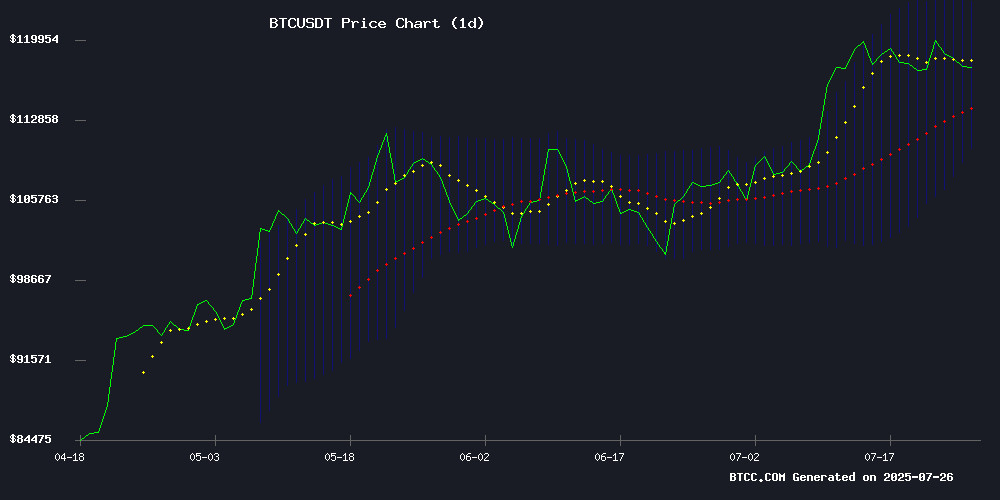

BTC is currently trading at, slightly above its 20-day moving average (116,852.12), indicating near-term bullish momentum. The MACD histogram shows a bullish crossover (+1,404.93), though both signal lines remain negative. Bollinger Bands suggest moderate volatility, with price hovering NEAR the upper band (123,381.79).says BTCC analyst John,

Market Sentiment: Institutional Moves and Macro Trends Fuel BTC Optimism

Headlines reflect adespite short-term uncertainties: MicroStrategy's $2.5B Bitcoin purchase plan and 35+ public companies holding 1K+ BTC signal institutional confidence. However, El Salvador's IMF tensions and a dormant whale moving 80K BTC inject caution.notes John.

Factors Influencing BTC’s Price

El Salvador’s Bitcoin Strategy Faces Doubts Amid IMF Pressure and Mixed Signals

El Salvador’s bold experiment with Bitcoin as legal tender faces mounting skepticism. In the mountain town of Berlin, locals still trade coffee for BTC, but the cryptocurrency’s role has diminished since the 2024 IMF agreement rendered its use optional and restricted government adoption efforts. The state holds 6,249 BTC ($738M) but surveys reveal 80% of citizens see no financial benefit.

Quentin Ehrenmann of My First Bitcoin notes the government’s pivot: public education campaigns have stalled, and IMF restrictions clash with the Bitcoin Office’s pro-crypto rhetoric. Meanwhile, grassroots efforts persist—a learning center in eastern El Salvador supports 200 businesses navigating cryptocurrency.

Japanese AI Firm Quantum Solutions Plans $350M Bitcoin Treasury Move

Quantum Solutions, a Tokyo-listed AI firm, is making waves in Japan's corporate crypto landscape with plans to acquire 3,000 Bitcoin over the next year—a $350 million bet that would mark the country's largest corporate BTC holding. The strategic accumulation, managed through its Hong Kong subsidiary GPT Pals Studio Limited, underscores Asia's growing appetite for Bitcoin as a reserve asset.

Integrated Asset Management (Asia) Limited, the Forbes Media owner backing the initiative, will provide an initial $10 million capital injection. "Quantum Solutions demonstrates clear strategic vision," said Tak Cheung Yam, founder of the asset management firm. The move signals institutional confidence in Bitcoin's long-term value proposition amid global treasury diversification trends.

MARA Holdings Stock Slumps Amid $1 Billion Note Offering, BTC-Fueled Rebound Speculated

MARA Holdings' stock tumbled 1.01% on July 25, 2025, following the announcement of a $1 billion convertible senior notes offering. The crypto-linked mining firm's private placement includes $950 million in zero-coupon notes due 2032, with an optional $200 million upsell for institutional buyers under Rule 144A.

Proceeds will address $18.3 million in 2026 note repurchases and $36.9 million for anti-dilution capped calls. Market observers eye a potential Bitcoin-correlated recovery, though the debt raise initially spooked investors. The offering's timing coincides with BTC's consolidation near key support levels, historically a catalyst for mining equities.

Galaxy Digital's $9B Bitcoin Sale Linked to 2011 MyBitcoin Hack, Says CryptoQuant CEO

Galaxy Digital's recent sale of 80,000 Bitcoin—worth over $9.4 billion—has sparked controversy after CryptoQuant CEO Ki Young Ju suggested the coins may originate from the 2011 MyBitcoin exchange hack. The dormant wallets, inactive since April 2011, resurfaced just months before the exchange collapsed following a breach that initially resulted in $72,000 in losses.

The timing raises questions about whether the funds belong to the hacker or MyBitcoin's vanished founder, Tom Williams. Galaxy Digital executed the sale via OTC deals, but Ju's findings imply potential ties to illicit activity. The revelation casts doubt on Galaxy's due diligence processes for large-scale transactions.

Public Companies Holding 1,000+ BTC Surge to 35 in Q3 2025

The number of public companies holding at least 1,000 Bitcoin has climbed steadily throughout 2025, marking a significant milestone in institutional adoption. From 24 firms in Q1 to 30 in Q2, the tally now stands at 35 and counting this quarter.

These corporate treasuries collectively safeguard over $116 billion worth of BTC, a staggering figure that underscores growing confidence in Bitcoin's role as a long-term store of value. The upward trajectory mirrors Wall Street's evolving perspective on cryptocurrency as a legitimate asset class rather than a speculative gamble.

MicroStrategy Upsizes Debt Offering to $2.5 Billion for Bitcoin Acquisitions

MicroStrategy's MSTR stock shows early signs of recovery following the company's decision to expand its convertible debt offering to $2.5 billion. The capital raise, priced at $90 per share for its Series A Perpetual Stretch Preferred Stock (STRC), will generate approximately $2.474 billion after underwriting fees.

Proceeds are earmarked for Bitcoin purchases and general corporate purposes. The move underscores MicroStrategy's unwavering commitment to cryptocurrency accumulation, with the company maintaining its position as the largest corporate BTC holder. STRC shares carry a variable dividend starting at 9.00% annually, payable monthly beginning August 2025.

Bitcoin Consolidates Amid Institutional Moves, Market Awaits Next Catalyst

Bitcoin's price action has entered a phase of unnerving stillness, trapped between $113,500 support and $120,000 resistance. The stalemate follows Galaxy Digital's reported transfer of 80,000 BTC to exchanges in late July, creating palpable selling pressure that continues to weigh on sentiment.

Technical analysts note the $113,500 level has transformed from mere support into a psychological battleground. Daan Crypto Trades observes Bitcoin tested range lows and swept local liquidity, warning that a breakdown could trigger accelerated selling. Meanwhile, blockchain sleuths track whale wallets repositioning assets—a maneuver historically preceding volatile moves.

The market remembers how previous institutional sell-offs paradoxically ignited altcoin rallies. Some traders now position for potential capital rotation, though conviction remains fragile without clearer signals. Galaxy Digital's latest 30,000 BTC transfer worth $3.5 billion hangs over the market like a suspended pendulum.

Ancient Whale Moves 80K BTC: Will Bitcoin Withstand the Selling Pressure?

A legendary Bitcoin whale has resurfaced, transferring 80,000 BTC worth approximately $9.54 billion between July 15 and 18. The coins, dormant for years, were moved at an average price of $118,950, raising questions about potential market impact.

Bitcoin currently trades between $115K and $121K, testing resistance at $125K. A breakout could propel prices toward $131K, representing nearly 9% upside. Despite a slight weekly dip, BTC has gained 9% monthly and 10% over six months, with technical indicators suggesting further room for growth.

Bitcoin Market Shows Caution as IBCI Enters Distribution Zone

Bitcoin's market cycle indicator, the IBCI index, has crossed into the distribution zone for the first time in five months—a phase historically associated with heightened investor enthusiasm and potential price ceilings. The current reading sits at the lower threshold (80%), significantly below levels seen during previous cycle peaks.

This marks the third distribution phase occurrence in the ongoing bull market. While analysts interpret the move as a cautionary signal for traders, they emphasize it doesn't portend an immediate steep correction. The tempered positioning suggests market participants are exercising restraint compared to prior cycle extremes.

Crypto Emerges as Potential Hedge Against Global Debt Crisis

Global debt has surged to a record $324 trillion in Q1 2025, stoking fears of an impending financial crisis. The U.S. economy—a key driver of global markets—faces declining growth and rising costs, amplifying systemic risks. Investors are increasingly eyeing cryptocurrencies as alternative stores of value amid eroding trust in traditional financial safeguards.

Bitcoin's fixed supply and decentralized architecture position it as a compelling hedge against inflation and dollar weakness. Yet its notorious volatility, regulatory uncertainty, and security vulnerabilities temper its appeal as a standalone solution. Diversification remains paramount in turbulent markets—crypto may fortify portfolios, but overreliance carries substantial risk.

Bitcoin’s Bull Run: Is 2025 Peak Coming Or Has The Cycle Changed?

Bitcoin's recent surge past $123,000 has reignited debates about its four-year market cycles. Historical patterns suggest a potential peak around October 2025, but growing institutional adoption may be rewriting the rules.

Market analysts observe fading cyclicality as spot ETFs and clearer regulations reshape investor behavior. "The halving's impact diminishes with each iteration," notes Bitwise CIO Matt Hougan, pointing to macroeconomic forces and institutional flows as new drivers.

ETF adoption represents a structural shift rather than cyclical momentum. This 5-10 year trend could fundamentally alter Bitcoin's relationship with traditional finance markets.

How High Will BTC Price Go?

John projects a Q3 2025 target range of 140K-150K USDT, contingent on these factors:

| Indicator | Current Value | Implication |

|---|---|---|

| Price vs 20MA | +1.06% above | Bullish momentum |

| MACD Histogram | +1,404.93 | Buying pressure building |

| Bollinger Band Position | Upper band at 123,381 | Room to test resistance |

Key risks include whale distributions and IMF policy impacts, but institutional accumulation appears to be the dominant force.